Trusted Globally. Proven Results. 25 Years of Innovation.

GRC SmartStart Modules

Our integrated modules offer a flexible and comprehensive platform for managing risk, compliance, and internal controls. With selectable modules that link together, you can build the best solution tailored to your needs. Each module provides focused insights and supports effective workflows and processes—empowering proactive decision-making, enhancing operational efficiency, and ensuring robust governance across your organisation.

Modular Design & Customisation

The modules can either be standalone solutions or in any combinations sitting within the integrated core platform.

Actions

Define and assign responsibility for objectives with deadlines, automated due date notifications, and overdue procedures for seamless GRC management.

Configurable Solution

Where the standard Optial module does not exactly match business requirements, Optial's platform-integrated Configuration feature provides what the business wants:

✔ Seamless Front-End Customisation – Ability to tightly meet exact business needs through front-end configuration.

✔ Guaranteed Compatibility – All configurations remain 100% backwards-compatible across software updates.

✔ Rapid Deployment – Achieve results quickly, whether for full production use or proof of concept.

✔ Evolving with Your Business – Ability to change over time, as business and regulatory drivers change.

✔ Low-Risk, Cost-Effective – Implement custom solutions efficiently without high costs or development risks.

Why GRC Software Matters

Effective Governance, Risk & Compliance (GRC) software is essential for aligning strategic objectives with robust risk management and compliance practices. It helps organisations anticipate challenges, streamline internal controls, and foster a culture of accountability.

Driving Strategic Value with GRC

GRC platforms embed risk insights directly into strategic decision-making. Real-time dashboards and data-rich insights streamline operations, uphold ethical standards, and power sustainable growth. By tightly aligning internal controls with ever-evolving regulations, organisations do more than stay compliant—they uncover and seize new strategic opportunities.

Simplifying Complexity in GRC

Ever-shifting regulations and emerging threats demand a GRC approach that is both comprehensive and agile. Modern GRC platforms tackle the complexity by centralising risk assessments, tracking regulatory changes, and triggering automated controls. With everything in one place, organisations can stay ahead of geopolitical, cyber, and operational risks—minimising exposure and strengthening resilience in a market that never stands still.

Key Benefits of Optial's GRC SmartStart Platform

Our comprehensive GRC solution unites specialised modules into one cohesive, integrated platform. Designed for flexibility and tailored to your organisation’s needs, it delivers real-time insights, streamlined processes, and robust risk monitoring. By seamlessly connecting risk management, compliance, audit, and business continuity, our solution empowers proactive decision-making and enhances overall resilience. This unified approach not only simplifies governance and risk oversight but also positions your organisation to navigate an ever-evolving regulatory landscape with confidence.

Modular & Integrated Architecture

-

Tailored Solutions - Build a GRC framework by selecting modules that best fit your organisation’s needs while ensuring seamless interconnectivity.

-

Holistic Approach: - Each module—whether risk, compliance, audit, or business continuity—contributes specialized insights to a unified platform.

Enhanced Risk Monitoring & Analytics

-

Real-Time Visibility - Obtain immediate insights through dynamic monitoring and predictive analytics, enabling proactive risk management.

-

Data-Driven Decisions - Leverage comprehensive risk assessments to drive informed strategic decisions across your organisation.

Streamlined Processes

-

Simplified Workflows - Centralise workflows like incident reporting, audit scheduling, and compliance tracking into efficient, easy-to-manage processes.

-

Improved Communication - Enhance cross-team collaboration with transparent, system-wide reporting and monitoring.

Business Resilience & Continuity

-

Robust Planning - Prepare for operational disruptions with proactive business continuity strategies.

-

Risk Mitigation - Minimize downtime and protect critical assets by integrating risk management and continuity planning into one cohesive system.

We Serve Organisations of Every Size

Any Organisation, Any Size

From a single user to a global workforce, Optial grows effortlessly with you.

Scalability for Growth

Adjust workflows and processes without disruptions, ensuring long-term success.

Global Usability

Engage teams worldwide with seamless adoption in local languages. Read more.

International Flexibility

Manage multi-currency transactions effortlessly, maintaining compliance and financial clarity.

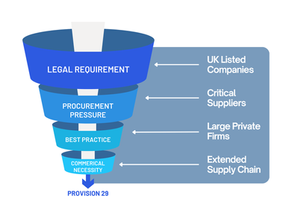

Ready for Provision 29?

From January 2026, UK boards must annually declare the effectiveness of all material controls. Our curated Provision 29 module set gives you everything needed for confident compliance—risk assessment, audit management, business continuity, and compliance monitoring in one integrated platform.

Industry-Specific Applications

Tailor your GRC approach with solutions designed to address the unique challenges of your industry. Our platform offers industry-specific applications that integrate seamlessly into your operations, ensuring targeted compliance, risk management, and business continuity.

Financial Services

-

Regulatory Compliance: Manage evolving regulatory requirements underpinned by a rigorous internal control environment.

-

Operational Risk Monitoring: Use dynamic, real-time insights to manage operational risks.

-

Audit & Reporting: Streamline audit processes to enhance transparency and accountability.

Manufacturing & Supply Chain

-

Operational Resilience: Monitor risks and exposures and ensure compliance to protect production lines.

-

Process Integration: Centralize incident reporting and audit management to improve operational efficiency.

-

Continuity Strategies: Develop robust business continuity plans to minimize downtime.

Customer Success:

Seamless JIRA-Optial Integration Elevates Incident Management for a Nordic Banking Group

A Stockholm-headquartered bank—serving customers across Sweden, the Baltics, Denmark, Finland, Norway, Germany, and the UK—has relied on Optial for enterprise risk and incident management since 2005. In 2024, the bank partnered with Optial consultants to link its JIRA platform with Optial’s incident module. Using the Optial Web API, critical incidents now flow between both systems in real time, ensuring every stakeholder sees the same, up-to-date record—no matter where the issue is first logged.

Key Successes

✔ Unified Incident Visibility

Bi-directional sync creates a single source of truth: incidents that meet predefined criteria in JIRA are auto-replicated in Optial (and vice versa), eliminating manual re-entry and version conflicts.

✔ Real-Time Stakeholder Alerts

Role-based email notifications instantly flag new or updated incidents—clearly showing whether they originated in JIRA or Optial—so risk managers and business leaders can respond without delay.

✔ Configurable, Future-Proof Platform

The project retired obsolete incident types, refined user-permissions, and added a “watch-list” feature for business-unit leaders—demonstrating how Optial’s flexible architecture adapts to evolving processes and regulatory demands.