Marginalen Bank

- cormacobrien8

- Nov 9, 2020

- 4 min read

Updated: Jul 2, 2025

How Marginalen Bank enables visibility and ownership of risk, compliance and audit activities by providing bank-wide employee access to the Optial GRC platform

Overview

Marginalen Bank wanted a GRC solution that would align to their business model and improve visibility, awareness and understanding of the operational risk environment for all employees. It needed a solution that supported this vision and that could be configured and aligned to audit, governance, risk and compliance functions.

The Optial GRC platform provided the functionality and configurability that met the Bank requirements of flexibility, scalability and accessibility.

Approach

Optial met the Marginalen project team in Stockholm to discuss and review the divergence required from the standard Optial platform to the Risk Control team’s documented configuration requirements. These sessions started an open and pragmatic dialogue on achieving the requirements. The sessions gave rise to the configuration activities in order to deliver according to the agreed requirements.

In addition, the project ran alongside Optial platform enhancements, which included: -

User Interface (UI) changes to help make the workflow more intuitive and visual for a larger user audience.

Real time dynamic feedback for the user when completing a risk assessment to better comprehend the relationship between risk impact, probability and mitigation activities.

Holistic visualisation of Inter-relating data items to support the objective of providing a clearer view of the risk environment.

The system was designed and built over the course of 12 months in two main phases. The entire system is available in both Swedish and English. Guides on each of the key functions were also produced and distributed within the Bank.

A third phase is due to be rolled out 2020Q4, which includes New Product Approvals and Business Continuity Planning processes.

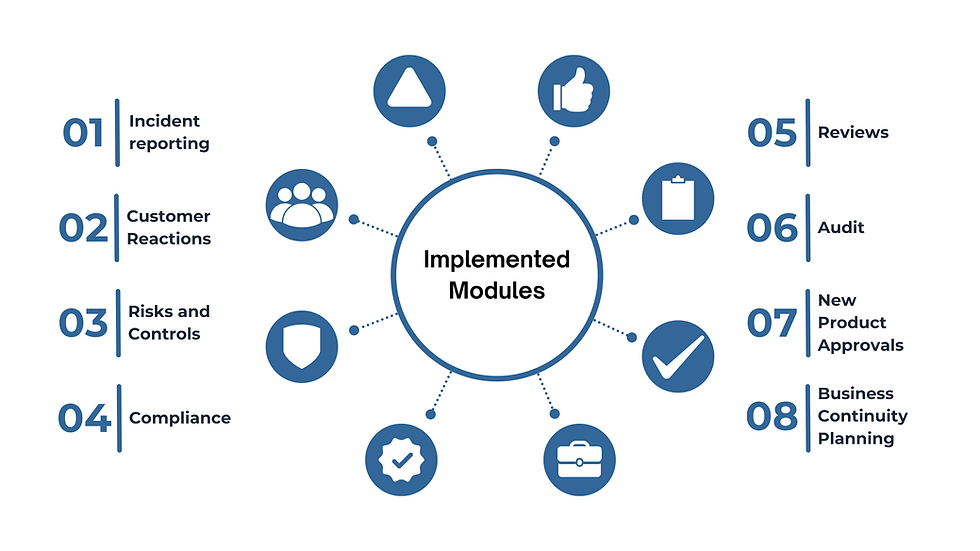

Modules Deployed

The modules deployed include:

1. Incident Reporting Optial Incident Reporting Workflow (Swedish)

Incident reporting includes the ability to report or log any incident or issue for the organisation and can be input by all employees. The associated workflow ensures the timely notification of severe incidents and the ability to link to risks and customer reactions ensures the context of the incident is understood.

2. Customer Reactions Customer reactions can be input by all employees and includes the ability to report or log any customer related issue. Workflow notifications ensure that the Customer Ombudsman has an awareness of all customer reactions and reporting provides the ability to understand what activities in the bank are generating customer reactions.

3. Risks and Controls The RCSA function is open to all employees. A range of reporting gives the risk control team the ability to view and analyse the risk environment and drive discussion.

4. Compliance Compliance regulation monitoring and policy management. This module supports the processes of the Compliance team to ensure that the bank is aware of regulatory responsibilities and policy implementation.

5. Reviews

Reviews is a generic function that provides the risk and compliance teams the ability to undertake reviews and capture review findings and actions across the organisation.

6. Audit

The audit module provides a segregated area of the system for the secure management of audit activities. The Audit team has the ability to create and schedule audit plans; scheduled audits are then managed to completion with identified findings, actions and reporting.

7. New Product Approvals (2020 Q4 rollout) New/amended products, services processes, IT-systems and markets are proposed directly in the system and the process of review and approval managed and documented,

8. Business Continuity Process Planning (2020 Q4 rollout)

Capture the Business Continuity Plan in the system with a review process ensuring that the yearly assessment captures the current processes and includes all critical resources as well as keeping the information available in the system.

Outcome

Marginalen Bank empowers staff bank-wide to be directly involved with GRC. The system aligns with Bank organisational culture and is embedded into day-to-day processes and operations withstanding reviews and challenges from a large user base.

Driven from the very top levels of the organisation, user adoption is high, and the system is well-received.

The Optial GRC solution for Marginalen Bank is an example of how Optial works closely with clients to take a standard, off -the-shelf product and, through configuration rather than coding, deliver a stable, economical and tailored solution.

About Marginalen Bank

Facts and figures

· Marginalen Bank was founded 2010.

· Approximately 300 employees in Sweden.

· Around 300.000 customers.

· Supervised by Finansinspektionen (FI)

· Covered by the Swedish government’s deposit guarantee scheme.

· Marginalen Bank is ISO certified.

· Marginalen Bank is owned by Marginalen AB.

We believe that more people should benefit from competitive, straightforward financial services. Regardless of your circumstances, our loans, cards and accounts are designed to meet your changing needs. Private customers can borrow up to 350 000 sek in unsecured loans and omstartslånet is designed to help people with low credit ratings restructure their finances. Our credit cards offer a reward system that fits your style of living and you will also benefit from purchase and travel insurance wherever you shop.

We believe that customers should benefit from competitive interest rates and we have some of the markets most competitive interest rates. All our savings accounts are covered by the Swedish government’s deposit guarantee scheme.

For our corporate customers, Marginalen Bank offers a wide range of financial and administrative services. As successful entrepreneurs ourselves, we have the experience and insight to advise businesses at all stages of the growth cycle. We can assist with growth financing, invoicing, business loans, leasing and hire purchase.